Impending rate hikes from the Fed have been in the "we’ll believe it when we see it" category for the past few years. The first week of August brought the first solid indications that the Fed will actually go through with a September rate increase. Atlanta Fed president Lockhart was quoted saying it would take serious deterioration in the economy to delay a September hike. Friday's jobs report was good enough to keep the plan intact.

On top of that, corporate earnings continued to roll out with what appeared to be as many misses as beats. Oil remains below $50 on a downward trajectory. These factors helped send the Dow and S&P down 2% and 1.5%, respectively, on the week. Contributing to the S&P drop was a 5% weekly slide for Apple.

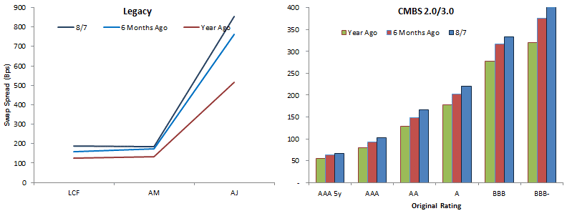

Two new conduit CMBS deals priced on Thursday and another two were in the works on Friday. According to Commercial Mortgage Alert, CSAIL 2015-C3 ($1.4B) and CGCMT 2015-P1 ($1.1B) priced their long AAA bonds at 107 and 106 bps over swaps, respectively. Both deal's BBB- tranches went for 390 bps over swaps.

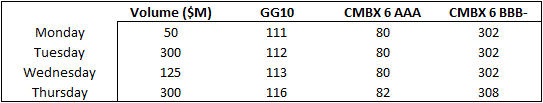

Legacy AMs, LCFs, and AJs gapped out 5 to 10 bps on average, with 2005 vintages showing the most volatility as more loans approach maturity. Trading volume reached $300 million on Tuesday and Thursday but otherwise was relatively anemic. We expect that to be the case throughout the rest of August, which is a normally quiet month.

Two large impending modifications ($317M Empirian Multifamily Pool 2 in MLCFC 2007-8 and $144.2M Colony IV Portfolio in JPMCC 2006-LDP9) came to light this week as well. We will continue to monitor those as August data rolls in.

Finally, Fox News held the first Republican presidential primary debates on Thursday. The main event garnered 24 million viewers. but Nielsen has yet to release the exact percentage of viewers watching just to see what "The Donald" would say (we assume the majority). Carly Fiorina and Marco Rubio seemed to be the big gainers on Thursday, but we're sure the only name that will matter to investors in the near term is Janet Yellen.

CMBS Swap Spreads

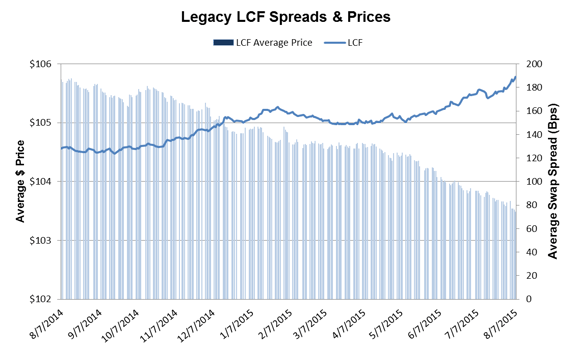

Legacy LCF Price and Swap Spread Movement