Wednesday, December 2, 2015

November S&P Summary

• It was a relatively quiet month in U.S. equities. U.S. large-cap dispersion fell modestly in November to 5.6% as it continued to move within a tight range. U.S. small-cap dispersion remained high even in comparison to longer-term averages.

• A similar picture held across most developed markets; the exception was Australia, which has seen its equity markets battered by external forces in recent months. This month, a return to bearish form in commodities saw dispersion in the S&P/ASX 200 rise to its highest levels in two years; correlations also rose in a month of relatively elevated volatility 'down under.'

• Excepting Australia, correlations were largely unchanged across our developed benchmarks and declined (along with volatility) in China and the S&P Emerging BMI.

Wednesday, November 25, 2015

CMBS delinquencies edge up in October

The delinquency rate on commercial-mortgage backed securities jumped slightly in October, but the story continues to be that bubble-era loans backing CMBS are being refinanced and paid off, Morningstar Credit Ratings reported.

The delinquency rate increased two basis points to 3.51 percent, but remains 64 basis points below the level of one year ago, Morningstar reported.

Analysts have been concerned about a wave of highly leveraged loans in CMBS that were originated during a period of looser standards between 2005 and 2007.

In its latest surveillance report, however, Morningstar said that the principal balance of CMBS declined by $9.97 billion in the month, an indicator that payoffs on 2005-to-2007 era loans are picking up.

The delinquent balance fell to $27.67 billion in October, down 13.6 percent in one year, Morningstar reported.

Wednesday, August 26, 2015

Commercial Real Estate Property Brokers Experience Profit Drop as Market Slows Down

Commercial Property companies are starting to experience decrease in their profits as the commercial real estate market start to lose its heat.

According to Bloomberg.com, CBRE Group Inc. and Jones Lang LaSalle Inc. experienced their biggest loss since 2011 due to difficulties in equities. The loss brought a 14% drop for CBRE Group and 16% for Jones Lang LaSalle. HFF Inc. dropped with 20% in August while Marcus & Millichap Inc. dropped with 17%.

The possible further decrease in real estate transactions is raising concern among big brokerage firms that their profit will also decline together with the transactions. The possible drop in profit might cause for the firms to lease their properties instead of selling them.

Brad Burke, analyst at Goldman Sachs Group Inc., said that the profit growth at the companies "is in the rear- view mirror at this point. This is a natural maturing of the real estate cycle."

According to Real Capital Analytic Inc., commercial real estate transactions in the U.S. increase with 23% during last year's second quarter. Major several sales made early last year had "front- loaded" the first half volume of $255.1 billion. Two industrial portfolio were included in the transaction, namely Manhattan's Waldorf Astoria Hotels and Willis Tower in Chicago.

Sam Chandan, founder and chief economist of Chandan Economics, said that "We have had a very rich transaction market for some time, so the rate of growth in activity has necessarily begun to taper off. It's not the kind of growth we saw when we were coming off the bottom."

According to ChicagoBusiness.com, a quarterly report from Federal Reserve Data revealed that "the expansion in real estate lending is slowing." A 2.7% increase in outstanding commercial- mortgage debt in 2013 was observed and it raised again by 4.2% last year.

Various factors affect the slowdown in commercial property market business. Some of those factors were a strong dollar's effect non- U.S. profit, drop in oil prices that causes decrease in real estate demand "energy hubs" such as Calgary and Houston.

Labels:

Bloomberg,

Calgary,

CBRE,

Chicago Business,

Federal Reserve,

Goldman Sachs,

HFF,

Houston,

Jones Lang LaSalle,

Marcus and Millichap,

Real Capital Analytics,

Sears Tower,

Waldorf Astora,

Willis Tower

Thursday, August 20, 2015

Commercial real estate market getting overpriced

The commercial real estate market is shifting to an overpriced market, especially for core properties in the top markets, said real estate research firm Situs RERC, in a second-quarter report issued Tuesday, August 18, 2015.

“In the previous cycle (that ended in 2008), prices increased over true values by more than 50%, and it would not be surprising to see something similar in the current cycle,” the report said.

Commercial real estate transaction volume rose 23% for the year ended June 30, the report said, citing data from research firm Real Capital Analytics. Prices increased on a year-over-year basis for four out of five property types: up 10% for the industrial sector, 11% for both retail and apartments, and 19% for the hotel sector. Office prices were flat during the period.

Overall, commercial real estate value was higher than property prices in the second quarter, with a rating of 5.2 on a scale of 1 to 10, with 10 indicating excellent value compared to the price. Apartment and hotel sectors are somewhat overpriced with price ratings below 5, with apartments at 4.6, the same rating as in the first quarter and the second quarter of 2014, and hotels at 4.8, down from 5.4 in the first quarter and 5.7 in the second quarter of 2014. Retail was the only sector with an increased value vs. price rating in the second quarter, up to 5.5 from 5.1 in the first quarter and 4.9 in the second quarter of 2014.

Tuesday, August 11, 2015

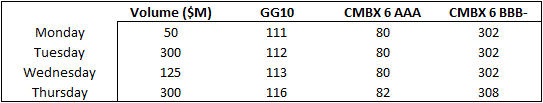

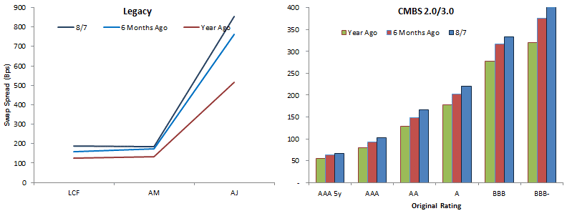

Soaring CMBS spreads highlight new risks on both sides of the Atlantic

Widening CMBS spreads on both sides of the Atlantic reflect an uptick in supply but also highlight that investors are increasingly wary of the latest structures and collateral, and are demanding higher compensation as a result.

Data show US spreads have widened to their highest levels in almost two years, while the latest pricing from Europe - Deco-2015 Charlemagne, a multi-jurisdiction deal - illustrates that issuers need to pay hefty premiums to place non-Triple A bonds.

Market sources told IFR this reflected heightened investor awareness of the risks ratcheting up in CMBS deals. "Complexity is creeping back into the structure and the general quality of the collateral has been deteriorating," a European investor said.

After the financial crunch, European issuers soothed investors with straightforward structures, simple collateral such as German multi-family properties, and strong sponsors. But over time they slowly reinserted risk into the deals - with weaker sponsors and secondary/tertiary properties.

"The first post-crisis issues were really investor-friendly, but this is becoming less and less the case now, which is causing investors to take a step back," one investor said.

US conduit CMBS spreads on new-issue deals rated Single A- rose as high as 275bp in July from as low as 190bp in April, according to Morgan Stanley data. The last time spreads in the middle of the capital structure were this wide was the third quarter of 2013, according to JP Morgan data.

Another factor pushing pricing power back into the hands of investors is that issuers that exclude unfavourable ratings on lower-rung tranches end up paying for it. They are able to demand beefier margins for tranches that fail to get solid ratings from at least one major agency, according to Bank of America Merrill Lynch analyst Alan Todd.

Investors Less Naive

That trend, which Todd said had now more clearly crystallised since mid-May, might indicate that investors are less naive about the quality of the underlying collateral.

The fact that, contrary to other asset classes, the CMBS segment has not bounced back from heightened global economic uncertainties - specifically negative Greek and Chinese headlines in early summer - would appear to confirm this.

With Greek debt woes on the backburner, CMBS spreads have continued to languish at wider levels. Growing concerns over real estate loan underwriting standards could explain this, one investor at a New York-based asset manager said.

"I continue to be surprised by what I see getting underwritten."

The US investor said the continued onslaught of new deals had also kept pressure on spreads. CMBS issuance of US$71bn this year is running 26% higher than the same period of 2014, according to Bank of America Merrill Lynch data.

The European primary has also witnessed a surge in supply - with two deals pricing in the same week for the first time since the crisis. Deutsche Bank had to pay plus 525bp on BBB-/BB bonds and plus 425bp on BBB+/BBB notes at the end of July to place its Deco-2015 Charlemagne deal - 145bp more than initial talk.

Single As were also priced significantly wider to initial levels, at 290bp against 220bp.

While the two bankers blamed the painful results on general market weakness and mounting CMBS supply, the European investor was more suspicious, saying: "Investors may not want to spend their time taking a long hard look at CMBS structures and collateral that have wrinkles in them."

Labels:

Alan Todd,

Bank of America Merrill Lynch,

CMBS,

Germany,

JPMorgan,

London,

Morgan Stanley

High Leverage for Apartment Loans Troubles Moody’s

With prices so high for apartment properties, any loan based on today’s appraised values is going to look very large compared to historic prices. But multifamily CMBS loans are especially troublesome, according to Moody's Investors Service.

“The credit quality of U.S. conduit/fusion commercial mortgage-backed securities (CMBS) continues to deteriorate, with conduit loan leverage in the second quarter pushing past its 2007 peak,” reads a July report from Moody’s.

These loans may look relatively modest compared to the appraised value of the apartments properties now. But if prices were to fall, a number of these loans might be in serious trouble. Lending experts argue that problems may be mitigated by stronger loan underwriting standards overall. Also, property prices may have even more room to rise relative to the income from apartment properties, and don’t have to fall anytime soon, as interest rates creep upwards, according to some apartment experts.

“Lenders are holding to pretty good underwriting standards,” says Bill Hughes, senior vice president for Marcus & Millichap Capital Markets. For example, lenders still resist to the urge to offers loans with interest-only periods longer then a few years, unless the loan is relatively low leverage, covering less than 60 percent of the property’s appraised value.

Moody’s: Underwriting way past the peak

The average CMBS loan was equal to 117.8 percent the value of the property in the second quarter, as measured by the Moody’s loan-to-value (LTV) metric. That’s very high–largely because Moody’s LTV compares loans to historic property values, instead of the high values that properties are appraised for in today’s market. The average CMBS loan was equal to 66.4 percent on average of the underwritten value of its property over the same period, according to Moody’s.

“The appraisals on Q2 collateral fully reflect the run-up in commercial property prices to levels that top the pre-crisis peak, while our values use a through-the-cycle approach,” according to Moody’s.

Just to compare, in the third quarter of 2007 the average CMBS loan has an average Moody’s LTV of 117.5 percent on average of the underwritten value of its property over the same period. In response to rising leverage, Moody’s is getting tougher in its CMBS ratings, giving fewer bonds in every CMBS issue the coveted AAA rating because the rating agency expects losses.

“Loans sized to 70 percent of peak values likely will under-perform those sized to 70 percent of trough values, as can be seen by comparing loans from the 2007 peak with those from mid-cycle 2003,” says Tad Phillipp, Moody's director of commercial real estate research.

Sky-high prices

The issue of leverage affects the whole business of lending to apartment properties, not just the CMBS business, because it is driven by high prices for apartments.

Lenders are still avoiding some of the worst practices of the real estate boom, however. For example, lenders still require borrowers to show the expenses from a property on a trailing, 12-month basis, says Hughes. Also, borrowers typically can’t get away with forecasting rents that would justify a larger loan, even though the property has now history of earning those high rents.

“I’m not really seeing any of that,” says Hughes. That restraint makes measurements like a loan’s debt service coverage ratios much more meaningful today than it was during the last boom, when giant loans were made based on rosy projections of high rents and low expenses.

Even though apartment properties are selling at historically high prices, by at least one measure prices have room to rise even further. Apartment properties now sell at average cap rates of 5.5 percent. That’s 320 basis points higher than the yield on 10-year Treasury bonds. Just to compare, in 2006 at the height of the boom, cap rates were just 100 basis points higher, according to Institutional Property Advisors.

Cap rates are likely to get a little closer to the yield on 10-year Treasuries. “As investors seek opportunities in secondary and tertiary markets throughout 2015 and compress cap rates there, the spread nationwide to the 10-year will continue to narrow,” according to Institutional Property Advisors.

Interest rate outlook: Federal Reserve

The benchmark yield on 10-year Treasury bonds is also likely to stay relatively low for a long time. “Even the anticipated increase in the Federal Reserve’s benchmark later this year will likely have minimal short-term effect on long-term rates,” according to Institutional Property Advisors. That’s because the bond markets have expected the Fed to inch rates upwards for a very long time, and there is not much in the latest economic reports to pressure the Fed to act quickly. A strong dollar and low energy prices are helping keep inflation below the Fed’s target of 2 percent. “The Fed has the maneuvering room to adjust rates very slowly,” according to Institutional Property Advisors.

Labels:

CMBS,

Federal Reserve,

interest rates,

Moody's,

multifamily

Monday, August 10, 2015

Signs of Inevitable Fed Rate Hike Affect Financial Markets

Impending rate hikes from the Fed have been in the "we’ll believe it when we see it" category for the past few years. The first week of August brought the first solid indications that the Fed will actually go through with a September rate increase. Atlanta Fed president Lockhart was quoted saying it would take serious deterioration in the economy to delay a September hike. Friday's jobs report was good enough to keep the plan intact.

On top of that, corporate earnings continued to roll out with what appeared to be as many misses as beats. Oil remains below $50 on a downward trajectory. These factors helped send the Dow and S&P down 2% and 1.5%, respectively, on the week. Contributing to the S&P drop was a 5% weekly slide for Apple.

Two new conduit CMBS deals priced on Thursday and another two were in the works on Friday. According to Commercial Mortgage Alert, CSAIL 2015-C3 ($1.4B) and CGCMT 2015-P1 ($1.1B) priced their long AAA bonds at 107 and 106 bps over swaps, respectively. Both deal's BBB- tranches went for 390 bps over swaps.

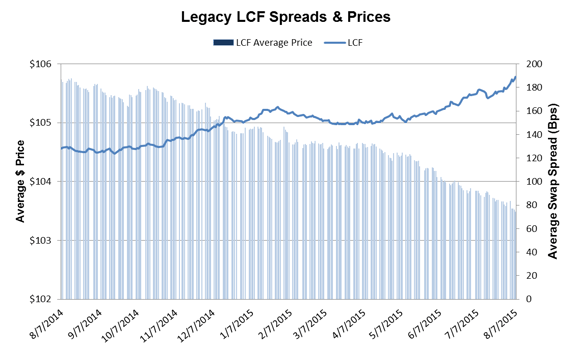

Legacy AMs, LCFs, and AJs gapped out 5 to 10 bps on average, with 2005 vintages showing the most volatility as more loans approach maturity. Trading volume reached $300 million on Tuesday and Thursday but otherwise was relatively anemic. We expect that to be the case throughout the rest of August, which is a normally quiet month.

Two large impending modifications ($317M Empirian Multifamily Pool 2 in MLCFC 2007-8 and $144.2M Colony IV Portfolio in JPMCC 2006-LDP9) came to light this week as well. We will continue to monitor those as August data rolls in.

Finally, Fox News held the first Republican presidential primary debates on Thursday. The main event garnered 24 million viewers. but Nielsen has yet to release the exact percentage of viewers watching just to see what "The Donald" would say (we assume the majority). Carly Fiorina and Marco Rubio seemed to be the big gainers on Thursday, but we're sure the only name that will matter to investors in the near term is Janet Yellen.

CMBS Swap Spreads

Legacy LCF Price and Swap Spread Movement

Tuesday, August 4, 2015

CMBS Late-Pays Back on Right Track

Following an uptick in June, CMBS delinquencies continued their downward trend in July,Trepp LLC said Monday. The Trepp CMBS Delinquency Rate inched down three basis points last month to 5.42%, with the rate of seriously delinquent loans at 5.22%.

Trepp says the delinquency rate has fallen 23 times over the past 27 months. The rate at July 31 is 62 bps lower than the year-ago level, and 33 bps lower year-to-date.

During July, $1.4 billion in loans became newly delinquent, putting 27 bps of upward pressure on the delinquency rate. About $600 million in loans were cured last month, which conversely helped push delinquencies lower by 12 bps.

CMBS loans that were previously delinquent but paid off with a loss or at par totaled slightly more than $800 million in July. Removing these previously distressed assets from the numerator of the delinquency calculation helped move the rate down by 15 bps, according to Trepp.

Although the general trend for CMBS delinquency is improvement, July’s rising tide did not lift all boats. Trepp says retail improved by three bps to 5.51% and hotels by five bps to 3.7%; lodging remains the best performing major property type. However, industrial late-pays rose 29 bps to 7.41%, while office and apartments each inched up three bps to 5.93% and 8.76%, respectively. Apartment loans continued their run as the worst performing among the major property types.

Wednesday, July 29, 2015

How the Modern Workplace is Reshaping the Office Market

With the pervasion of smartphones, laptops, and tablets, the 21st century workplace is no longer confined to leasable office space; workers can conduct business just about anywhere. According to workplace design company Knoll, workers now spend just 49% of their time in a company’s main office.

In addition to increased flexibility, the workforce is changing. According to workplace expert and author Jacob Morgan, Millennials are projected to comprise 50% of the workforce by 2020 and 75% by 2025. Between the need to entice workers back into offices and a growing cohort of employees that expect work environments to support their work-life balance, office space design has changed drastically.

The new model of office environments focuses on fostering collaboration, with open floor plans and few private offices. Some companies have taken that concept one step further and are choosing to occupy shared space with other firms through membership platforms such as WeWork.

Google, which is known for its innovative work spaces, has a "150-feet from food" rule. The idea that no part of the office should be more than 150 feet from sustenance (be it in the form of a restaurant, cafeteria, or mini-kitchen) is rooted in collaboration. If employees are encouraged to snack, they are more likely to run into people they don't normally work with. Such encounters promote the creation of new ideas while facilitating camaraderie.

Opportunities for social stimulation and recreation have become increasingly important, as worker happiness leads to higher retention. Meanwhile, physical storage needs have been reduced, as paper files have been replaced with electronic files and cloud storage.

As these changes have spread from tech tenants to more traditional office occupants, the way tenants use office space has necessitated significant improvements to keep existing buildings from becoming functionally obsolete. As part of this transformation, tenants are leasing less space per employee, requiring many existing buildings to undergo substantial retrofitting to attract tenants.

Keep in mind that right now, most companies are trying to catch up with the office trends set forth by preeminent technology firms such as Facebook, Twitter, Lyft, Adobe, YouTube, and Airbnb. But many those offices were adapted for the company. New trends are being established as companies choose to build from the ground up, which provides more design flexibility.

For example, in the massive Bay View Google campus that is under construction, employees will always be about three minutes away from every other employee. All indoor space will be optimized for natural light, and outdoor space will play a significant role in employees' day-to-day job functions. As these office layouts prove themselves successful, other companies will attempt to mimic the designs, resulting in additional modifications. And in this case, modifications mean construction.

The changes tenants are requiring of their existing office space will reshape the office market, leading to fluctuations in vacancies, subletting, construction, and occupancies. Ultimately, retrofitting existing properties should lead to increased rent per square foot and occupancy levels.The possibility exists, of course, that certain older buildings will be left vacant if property owners choose not to undergo significant upgrades. Regardless, this paradigm shift in what office environments should accomplish will take time to be reflected across the market and will affect tenanting in the interim.

Tuesday, July 14, 2015

CMBS Delinquency Rate Rose Slightly in June: Fitch

Loans backing commercial mortgage-backed securities saw a slight uptick in delinquencies last month, Fitch Ratings reported.

Fitch's CMBS index saw a six-basis-point rise in delinquencies during the month of June, up to 4.54% the agency said. The balance of delinquent CMBS loans grew about $65 million, to $17.17 billion, from the prior month.

New delinquencies outgrew the dollar amount of bad loan resolutions by $96 million. Meanwhile, portfolio runoff outpaced new issuances in the month of May (the month used by Fitch for the denominator value in its CMBS index calculation), $5.4 billion versus $1.6 billion.

Retail properties had the highest CMBS delinquency rates at 5.44% in June, an increase of 18 basis points from the month before, while hotel properties followed not far behind at 5.2%, an increase of two basis points from May. Mixed-use properties had the lowest delinquency rate of asset categories specified by Fitch, with a 3.68% delinquency rate, though that rose significantly (178 basis points) from the month before.

3 Tech Trends That Will Transform Real Estate

Three emerging technology trends are going to impact the future of real estate and how people work, live and play, according to Elie Finegold, CBRE Group Inc.’s senior vice president of global innovation and business intelligence.

“Quite simply, we are going through a period of intensely rapid and actually accelerating technological change that is penetrating every aspect of our lives—and will continue to persist for the foreseeable future,” Finegold told Commercial Property Executive. “The challenge for real estate leaders will be to keep eyes on this different future while still creating value for existing asset bases.”

From broad access to WiFi and the ubiquity of smartphones to ever-lighter laptops and more powerful tablet devices, the virtual barrier between work and home is all but gone, and the way people think about real estate is fundamentally changing.

“The technology thread is undoubtedly the continuing rise in power and decline in cost of computing, which drives most of the other incredible innovations,” Finegold added. “But the deep human thread is that we are going through a profound transformation in how we live and how we work, how we grow up and how we grow old. We’ll still be doing all of that in buildings, but it is going to be a very different experience.”

According to Finegold, these three trends will reshape the way people use real estate in the future:

- radical mobility;

- a collaborative economy;

- the transportation revolution, with the ability of people and machines to work from anywhere likely to transform the utilization of traditional spaces.

“I think the collaborative economy accelerates and deepens the impact of autonomous vehicles. In many major cities, if you average less than 10,000 miles per year, it is already cheaper and easier to Uber than to own your own car,” Finegold said. “This means that for many people transportation will become a cheap and ubiquitous service—much like we have given up CDs for streaming services, people in a lot of urban areas will abandon their own cars for a cheap, driverless chauffer. It stands to profoundly change the cost of living in cities, while being at least price competitive with mass transit, highway infrastructure, and owning a car.”

Finegold expects the most disruptive technological advancement will be safe, completely “robotic” cars and trucks.

“Fully autonomous vehicles are already licensed in certain states, and will probably be fairly common by 2020 or so,” he said. “I think it will have a profound effect on how we move goods and people through and between cities, creating a far greener and more efficient experience, but also leaving us with a lot of infrastructure and city planning that we will need to repurpose.”

While some of these trends may be in the distant future, aspects of all three already exist, and are quickly creating new modes for people to access real estate, Finegold concluded.

Oil's Impact on Commercial Real Estate

Perhaps more so than any other industry, oil and its pricing volatility impacts all elements of the U.S. economy, both positively and negatively. Looking at it from a macroeconomic level, higher oil prices are good for some industries, and yet bad for others—and the same goes for lower prices. So overall, how does oil and energy affect the commercial real estate economy? Well, almost in the exact same way, if you break it down.

According to recent statistics from the U.S. Energy Information Administration., U.S. oil production will grow to 9.31 million barrels daily by 2016, so the industry is still healthy production-wise. But for the past few years, prices have remained low and are expected to remain steady or even decline for the foreseeable future. Where this has the greatest impact for commercial real estate is in the retail sector. It’s a simple equation: Reduced gas prices cause a boost in discretionary income and the end result is additional spending for the country. Money that would be typically earmarked towards filling car and home gas tanks now remains in the wallets of U.S. consumers and retailers are the clear beneficiaries.

It’s not a coincidence that the retail sector has shown a marked improvement as oil prices have plummeted. The 2014 holiday retail sales were strong and 2015 is expected to be much the same. By extension, another byproduct winner in this ripple effect are operators of industrial properties, particularly as online retail demand triggers the movement of purchased items through their facilities.

But while retailers and shopping center and industrial building owners celebrate continued affordable gas prices, commercial real estate within markets like Houston, where oil production is the “bread and butter” business, the news is not so welcome. In fact, the entire state of Texas, our country’s number one oil drilling state, has really been squeezed by the price decline.

The Lone Star State is always subject to the underlying forces of the energy sector. When oil fundamentals are strong and prices are up, Texas is a national economic leader. But when the opposite occurs, stunted financial growth is the unfortunate result. This decline has seeped into most of the regional commercial real estate segments such as the Texas office and retail sectors. In addition, a slowdown in local construction has been steadily occurring. Fortunately, Texans have learned from previous oil crunches to diversify the businesses to avoid being completely beholden to the energy industry—so while there has been some job loss, it has been mitigated to some degree.

But Texas and other localized markets specializing in energy aside, the current state of the oil industry and its lower than normal prices and the uplift in consumer spending has generally been considered a good thing for commercial real estate. While the long-term future of oil prices remains a mystery, retailers will still be able to ride this wave for the time being.

According to recent statistics from the U.S. Energy Information Administration., U.S. oil production will grow to 9.31 million barrels daily by 2016, so the industry is still healthy production-wise. But for the past few years, prices have remained low and are expected to remain steady or even decline for the foreseeable future. Where this has the greatest impact for commercial real estate is in the retail sector. It’s a simple equation: Reduced gas prices cause a boost in discretionary income and the end result is additional spending for the country. Money that would be typically earmarked towards filling car and home gas tanks now remains in the wallets of U.S. consumers and retailers are the clear beneficiaries.

It’s not a coincidence that the retail sector has shown a marked improvement as oil prices have plummeted. The 2014 holiday retail sales were strong and 2015 is expected to be much the same. By extension, another byproduct winner in this ripple effect are operators of industrial properties, particularly as online retail demand triggers the movement of purchased items through their facilities.

But while retailers and shopping center and industrial building owners celebrate continued affordable gas prices, commercial real estate within markets like Houston, where oil production is the “bread and butter” business, the news is not so welcome. In fact, the entire state of Texas, our country’s number one oil drilling state, has really been squeezed by the price decline.

The Lone Star State is always subject to the underlying forces of the energy sector. When oil fundamentals are strong and prices are up, Texas is a national economic leader. But when the opposite occurs, stunted financial growth is the unfortunate result. This decline has seeped into most of the regional commercial real estate segments such as the Texas office and retail sectors. In addition, a slowdown in local construction has been steadily occurring. Fortunately, Texans have learned from previous oil crunches to diversify the businesses to avoid being completely beholden to the energy industry—so while there has been some job loss, it has been mitigated to some degree.

But Texas and other localized markets specializing in energy aside, the current state of the oil industry and its lower than normal prices and the uplift in consumer spending has generally been considered a good thing for commercial real estate. While the long-term future of oil prices remains a mystery, retailers will still be able to ride this wave for the time being.

Sunday, June 7, 2015

Is crowd funding the answer for developers left without financing from the banks?

The concept of syndicate investment and indirect investment in commercial property through vehicles such as investment funds and REITs is firmly established.

Investors, who may not otherwise have the expertise or financial wherewithal to purchase commercial real estate in their own right, essentially pool their resources and purchase property as part of a larger group. Considering the extent to which technology is advancing and new concepts are emerging, it is conceivable that a new phenomenon may reach us before long - that is the concept of "crowdfunding", which is becoming increasingly popular in real estate in the US and gaining traction in Europe and Asia.

Crowdfunding or peer-to-peer lending is described as "the practice of funding a project or venture by raising many small amounts of money from a large number of people, typically via the Internet".

There are now several well-established crowdfunding platforms including Kickstarter, Indiegogo, Rockethub, and Crowdcube, among others. Most of these are US platforms that have been expanding overseas into Europe and elsewhere. These platforms enable start-up businesses and entrepreneurs to launch and promote their business ideas online and give investors an opportunity to invest in this idea, often for a relatively small outlay.

It goes without saying that investing in start-ups and early stage businesses, whether through crowdfunding or otherwise, involves considerable risks, including illiquidity, lack of dividends, loss of investment and dilution. Crowdfunding should therefore only be undertaken as part of a diversified investment portfolio.

Property crowdfunding is the fastest growing segment of the market today. Following some regulation changes in the US in 2012, commercial real estate sponsors obtained the ability to broadly solicit and advertise to the public. This opened the door for real estate developers and owners to capitalize on modern digital marketing tools and leverage the reach of the Internet to reach a wider potential investor base. A study from Massolution reported that $2.5bn of crowdfunding occurred in the real estate sector in 2014 and this continues to rise.

A number of specialist real estate platforms are now in operation in the US including RealCrowd, Crowdstreet, Fundrise and Prodigy Network. In fact, the largest crowdfunding campaign ever was a real estate crowdfunding project organised by Prodigy Network. Its founder Rodrigo Niño has predicted that "Crowdfunding will disrupt the status quo of traditional equity investment in real estate."

In 2009, Niño helped build the first skyscraper in Bogota, Colombia, in 40 years. He financed much of the project by attracting small investors who invested $20,000 at a time. By 2013, he had raised over $190m for the BD Bacata project - a world record in crowdfunding. Many of the investors in this project, which has recently been completed, made returns of more than 40pc since purchasing shares. Prodigy Network has since moved on to other successful projects in New York including AKA Wall Street, 17 John and AKA United Nations. Another real estate crowdfunding vehicle Fundrise is currently offering approved investors an opportunity to invest in 3 World Trade Centre in New York.

These specialist real estate crowdfunding entities are targeting up to 10 million accredited investors in the United States who are looking for solid returns on tangible assets that can generate private equity type returns. Accredited individual investors can research the best private real estate operating companies, view current offerings, submit offers, fund investments and manage their commercial real estate portfolios from their personal crowdfunding accounts. The portfolio valuation of the largest real estate crowdfunding platform Prodigy Network's now stands at over $600m. They claim to have over 5,200 accredited investors on their books. Interestingly, they are now reportedly looking for institutional quality investment opportunities in Europe.

However, crowdfunding isn't yet an option for all interested in investing in commercial property. Although the core principle of crowdfunding is affording small investors the opportunity to invest in particular projects for relatively little outlay, many of the well-established real estate crowdfunding platforms in the US have high thresholds for accredited investors. To become an accredited investor and to be able to browse open investments on certain real estate crowdfunding platforms, in some cases you are required to have a net worth of at least $1m and to prove that you have a minimum annual income of $200,000 over a number of years in order to be accredited.

If you meet these criteria, you undoubtedly already have access to direct real estate investment opportunities and may prefer to invest in real estate in this way as opposed to pooling resources with many other investors on a crowdfunding platform in order to achieve a similar rate of return. However, as time goes on, these thresholds are likely to reduce giving a greater pool of potential investor's opportunities to invest in commercial property through crowd funding.

In a European context, Spain, Germany and the UK are expected to follow the lead of Italy, which recently became the first country to implement a law on equity crowdfunding.

The property industry is now fully au fait with syndication and REITs and the concept of collectively investing in large and diversified portfolios of commercial real estate across different geographies and jurisdictions. However, the likelihood is that technology will alter current models and streamline investment processes over the next few years with accredited investors increasingly evaluating the merits of investing in particular funds or schemes via highly supportive data rooms and websites in the first instance and making their actual investment via transparent crowdfunding type platforms. Over the last few years, technology has eliminated middle men and increased efficiencies in a plethora of different industries and it has the potential to do likewise in the real estate industry. Real estate crowdfunding has seen exponential growth over the last few years and is likely to continue to grow over the course of the next few years, particularly as the regulatory framework becomes more developed in many jurisdictions.

Investors, who may not otherwise have the expertise or financial wherewithal to purchase commercial real estate in their own right, essentially pool their resources and purchase property as part of a larger group. Considering the extent to which technology is advancing and new concepts are emerging, it is conceivable that a new phenomenon may reach us before long - that is the concept of "crowdfunding", which is becoming increasingly popular in real estate in the US and gaining traction in Europe and Asia.

Crowdfunding or peer-to-peer lending is described as "the practice of funding a project or venture by raising many small amounts of money from a large number of people, typically via the Internet".

There are now several well-established crowdfunding platforms including Kickstarter, Indiegogo, Rockethub, and Crowdcube, among others. Most of these are US platforms that have been expanding overseas into Europe and elsewhere. These platforms enable start-up businesses and entrepreneurs to launch and promote their business ideas online and give investors an opportunity to invest in this idea, often for a relatively small outlay.

It goes without saying that investing in start-ups and early stage businesses, whether through crowdfunding or otherwise, involves considerable risks, including illiquidity, lack of dividends, loss of investment and dilution. Crowdfunding should therefore only be undertaken as part of a diversified investment portfolio.

Property crowdfunding is the fastest growing segment of the market today. Following some regulation changes in the US in 2012, commercial real estate sponsors obtained the ability to broadly solicit and advertise to the public. This opened the door for real estate developers and owners to capitalize on modern digital marketing tools and leverage the reach of the Internet to reach a wider potential investor base. A study from Massolution reported that $2.5bn of crowdfunding occurred in the real estate sector in 2014 and this continues to rise.

A number of specialist real estate platforms are now in operation in the US including RealCrowd, Crowdstreet, Fundrise and Prodigy Network. In fact, the largest crowdfunding campaign ever was a real estate crowdfunding project organised by Prodigy Network. Its founder Rodrigo Niño has predicted that "Crowdfunding will disrupt the status quo of traditional equity investment in real estate."

In 2009, Niño helped build the first skyscraper in Bogota, Colombia, in 40 years. He financed much of the project by attracting small investors who invested $20,000 at a time. By 2013, he had raised over $190m for the BD Bacata project - a world record in crowdfunding. Many of the investors in this project, which has recently been completed, made returns of more than 40pc since purchasing shares. Prodigy Network has since moved on to other successful projects in New York including AKA Wall Street, 17 John and AKA United Nations. Another real estate crowdfunding vehicle Fundrise is currently offering approved investors an opportunity to invest in 3 World Trade Centre in New York.

These specialist real estate crowdfunding entities are targeting up to 10 million accredited investors in the United States who are looking for solid returns on tangible assets that can generate private equity type returns. Accredited individual investors can research the best private real estate operating companies, view current offerings, submit offers, fund investments and manage their commercial real estate portfolios from their personal crowdfunding accounts. The portfolio valuation of the largest real estate crowdfunding platform Prodigy Network's now stands at over $600m. They claim to have over 5,200 accredited investors on their books. Interestingly, they are now reportedly looking for institutional quality investment opportunities in Europe.

However, crowdfunding isn't yet an option for all interested in investing in commercial property. Although the core principle of crowdfunding is affording small investors the opportunity to invest in particular projects for relatively little outlay, many of the well-established real estate crowdfunding platforms in the US have high thresholds for accredited investors. To become an accredited investor and to be able to browse open investments on certain real estate crowdfunding platforms, in some cases you are required to have a net worth of at least $1m and to prove that you have a minimum annual income of $200,000 over a number of years in order to be accredited.

If you meet these criteria, you undoubtedly already have access to direct real estate investment opportunities and may prefer to invest in real estate in this way as opposed to pooling resources with many other investors on a crowdfunding platform in order to achieve a similar rate of return. However, as time goes on, these thresholds are likely to reduce giving a greater pool of potential investor's opportunities to invest in commercial property through crowd funding.

In a European context, Spain, Germany and the UK are expected to follow the lead of Italy, which recently became the first country to implement a law on equity crowdfunding.

The property industry is now fully au fait with syndication and REITs and the concept of collectively investing in large and diversified portfolios of commercial real estate across different geographies and jurisdictions. However, the likelihood is that technology will alter current models and streamline investment processes over the next few years with accredited investors increasingly evaluating the merits of investing in particular funds or schemes via highly supportive data rooms and websites in the first instance and making their actual investment via transparent crowdfunding type platforms. Over the last few years, technology has eliminated middle men and increased efficiencies in a plethora of different industries and it has the potential to do likewise in the real estate industry. Real estate crowdfunding has seen exponential growth over the last few years and is likely to continue to grow over the course of the next few years, particularly as the regulatory framework becomes more developed in many jurisdictions.

Labels:

crowd-sourcing,

Crowdcube,

crowdfunding,

Crowdstreet,

entrepreneurs,

Europe,

Fundrise,

Indiegogo,

investment,

Kickstarter,

Prodigy Network,

RealCrowd,

REIT,

Rockethub,

sydicate,

US

Thursday, May 28, 2015

First crowdfunded real estate project paying off

When Ben Miller decided to use crowdfunding as a means to rehabilitate a beaten-down building in one of Washington, D.C.'s transitional neighborhoods, he didn't really know crowdfunding was a thing, That's because it wasn't, at least not in real estate, yet.

But Miller and his brother Dan were raised in both a real estate family and in the social generation. Their goal—to give everyone the opportunity to invest in commercial real estate—was just intuitive to them. Previously, commercial real estate was a playground for large-scale investors only.

"We didn't know it would become a movement, and that the movement would be our business," said Ben Miller, standing in the finished project—an open, modern/industrial-style space called Maketto. "We raised $350,000 from 175 people at $100 a share, and now the industry will do a billion dollars a year, and we're doing a project a week and raising probably half a million dollars a day."

Fundrise is an online crowdfunding platform offering individual investors a chance to buy shares in a commercial real estate project. The returns come from both rental stream and the appreciation of the property itself.

That was what was so enticing about the first project on H Street, a transitional neighborhood just east of D.C's Union Station. Not only was the neighborhood on the verge of big growth, but it also begged for an anchor destination to get the ball rolling.

When you first walk into Maketto, it's not immediately clear what the place is—and that is literally by design. It is a bar, a designer coffee house, a bakery, a retail clothing and sneaker shop, and a restaurant with a James Beard-nominated chef. Independent vendors all feed off each other, literally, under one roof. By sharing the space, the rent is cheaper, and therefore the profit greater.

"The whole idea was to do something different, to do something that the neighborhood wanted, so the space is both a restaurant and high fashion, it has a cafe," Miller said. "It's called Maketto meant to be a communal market, and the people invested in this project not only own a piece of the real estate but also a piece of the restaurants."

Miller may call it a market, but really it is a floor plan for the future: A social network of retail and restaurant on three levels, with communal seating everywhere (even in the chef's kitchen), and open-air spaces on the roof. It is what the millennials moving into this now-trendy new neighborhood expect.

"The point is to get people in there from the minute you wake up in the morning for your coffee through your nighttime cocktail and to meet people while you're there. It invites you to chat," said Gina Schaefer, one of the "crowd" investors in the project.

Schaefer and her husband own 10 hardware stores in the District and in Baltimore, but they lease all their properties. Owning real estate was way beyond their means until Fundrise approached them with the crowdfunding platform. They bought into it, investing $10,000 in the project. Last year, they received their first dividend check.

"I think for us it was just being part of the sharing community and the movement, and even if it was just a piece, to say that we owned something," Schaefer said. "We never in a million years would be able to afford to own a property in Washington, along H Street, where everything is starting to grow."

On a sunny Friday, midmorning, Maketto was already humming.

Toward the back of the main floor, just past the well-stocked bar which, for now, is spread with an array of breakfast pastries, one patron sits alone, wired up to a conference call. She is sipping something from Vigilante Coffee, a vendor that has set up shop on the second floor. At a longer, communal table upstairs, two suited patrons appear to be in the midst of an interview.

Just past them, across the first roof garden where a young man sits reading on his laptop, you can see workers in the glass-enclosed kitchen preparing for the lunch crowd. On the outdoor third-roof level, a group of young women is hashing out a business plan over laptops, something that involves dancing. All this as an older couple walks into the front of the main floor, tempted by pastries on the bar, but stopping to browse the $100 shoelaces.

For Christopher Vigilante (that's his mother's maiden name actually), it was the opportunity to share in something bigger than his tiny coffee company.

"For business, it helps create a lifestyle brand. Folks that typically want to drink a high-end coffee can understand what really fine cuisine can be like, can also appreciate fine clothing, a shirt that might cost you a few extra dollars but will last you 10 years—these folks all kind of run in similar circles," said Vigilante, standing behind three glass spheres of bubbling brews, heated by Bunsen burners. "I think when you have the synergy of all these businesses, you get that lifestyle brand."

A brand that is solidly Millennial—shared—right down to the funding.

"A hundred companies have followed us into this space," said Miller, who has grown his crowdfunding company Fundrise from three to 30 employees. Fundrise recently raised $35 million for its technology platform, and Miller said he is hiring an employee a week.

Fundrise began raising money for the H Street property in 2012. Back then, Miller talked about how they had to work through an arduous process with the Securities and Exchange Commission in order to make this first-of-its-kind online equity offering for a real estate property happen. Now Fundrise is crowdfunding projects across the country.

Maketto is very nearly a visual manifestation of the philosophy behind its fundraising; put simply, a social structure grown out of social financing.

"You can tell when you interact with customers, who maybe put in that first hundred dollars to get this project off the ground, that they feel connected to the space in a different way than say any other coffee bar," Vigilante said.

As such, it is already transforming the neighborhood around it.

"We've created an anchor down this side of H Street, so it's drawing more people here," said Miller of the neighborhood, which, along with several new restaurants and fitness studios, will soon be home to a Whole Foods and more than 1,000 new apartment units. "It's probably the coolest project tin the whole city, and that's making it a destination. The real estate growth from this neighborhood has been sensational."

Miller estimates that the building itself has appreciated between 50 and 100 percent since the crowd brought it back to life. For the neighborhood, its contribution appears, so far, invaluable.

Labels:

crowd-sourcing,

crowdfunding,

D.C.,

Fundrise,

Washington

Wednesday, May 27, 2015

Bitcoin Gains Traction amid Steady Growth in Indonesia

Indonesia, one of the world’s most beautiful archipelagoes and travel destinations, has had a consistent increase in bitcoin adoption at popular tourist spots including Bali, Jakarta and Denpasar, since the launch of BitIslands in March 2014.

Initiated by the largest Indonesian Bitcoin exchange Bitcoin Indonesia, the project was sponsored by leading Bitcoin merchant platforms and mobile services in Asia, including a Singaporean startup Coin of Sale, Artabit, CoinPip, Quantified, Tukarcash and Bitwyre. Since 2014, Bitcoin Indonesia continued to aggressively push the project in Bali, where BitIslands launched a bitcoin Information Center and Bali’s first offline Bitcoin exchange.

Due to the increase of bitcoin’s market awareness and merchant adoption, the majority of the locals started to use bitcoin online, and began to appreciate bitcoin’s low transaction fees and speed, The Wall Street Journal reports.

“Most Indonesians currently use bitcoin to pay for services online, such as web hosting. They can also use the digital currency to book hotel rooms through travel websites hosted overseas rather than use credit cards, which only a small percentage of the population currently own,” the Journal article says.

Furthermore, major bitcoin exchanges such as Bitcoin Indonesia have seen a substantial growth in both the number of users and daily trading volumes. The largest bitcoin exchange in Indonesia currently trades around 200 bitcoin daily and supports more than 56,000 users.

“Many people think that Bitcoin is unheard of in Indonesia, but the fact is its popularity is soaring now,” Bitcoin Indonesia CEO Oscar Darmawan said.

In September 2014, several projects emerged to increase bitcoin mainstream adoption in the nation, by allowing Indonesian residents to purchase bitcoin at popular stores or tourist spots. The project ran by Bitcoin Indonesia enabled users of its exchange to purchase bitcoin at any of the 10,000 Indomarket convenience stores via a partnership with iPaymu, a merchant payment platform.

Such services, along with the rising volume of Bitcoin exchanges, influenced Indonesian merchants to accept bitcoin in other parts of Indonesia apart from Bali, where most of the Bitcoin projects began. Currently, Indonesia has more than 50 Bitcoin merchants, and the majority are located in Denpasar.

Rise of Bitcoin Start-ups

Since early 2015, some Bitcoin start-ups began to relocate to Indonesia, targeting the poor banking systems and payment infrastructure of the country. One of the start-ups was Blossom, which recently moved from San Francisco to Indonesia to offer the country’s first bitcoin-based global lending/investing platform.

Blossom connects international investors to small businesses in Indonesia which are ready to launch. Through an established local microfinance institution, Blossom delivers the bitcoin funds to the businesses. After 12 months, profits from the businesses are collected to be distributed to the investors, with around 7.5 percent to 12.5 percent in return.

“In conventional investment, I have to rely on the statements and numbers publicized by my partners. With Bitcoin, it’s clear to everyone what’s going on,” said founder Matthew Martin.

As the number of bitcoin merchants and trading volumes continue to grow at a consistent rate, Bitcoin startups and establishments, including Bitcoin Indonesia, aim to achieve mainstream bitcoin adoption in popular tourist spots in the country.

Wednesday, April 1, 2015

CMBS Delinquencies Unchanged in March as Loan Liquidations Remain Low

Trepp, LLC, the leading provider of information, analytics, and technology to the CMBS, commercial real estate, and banking markets, released its March 2015 US CMBS Delinquency Report today.

The Trepp CMBS Delinquency Rate was unchanged in March, interrupting the recent string of falling delinquencies. After falling for four consecutive months, the delinquency rate for US commercial real estate loans in CMBS remains 5.58%. The percentage of seriously delinquent loans, defined as those 60+ days delinquent, in foreclosure, REO, or non-performing balloons, fell one basis point to 5.41%.

Almost $1.1 billion in CMBS loans became newly delinquent in March, bringing total delinquencies to $29.4 billion, slightly below the total as of month-end February. Over $800 million loans were cured last month, while $570 million loans that were previously delinquent paid off either at par or with a loss.

The decline in the pace of loan resolutions does not come as a surprise. After a torrid pace in 2012 and 2013, liquidations have slowed for the time being. As the market gets further into the cycle of 2006 and 2007 10-year loans reaching their maturities, Trepp expects liquidation volume numbers to start to pick up again.

"The financial markets were turbulent in March, but the CMBS market remained a sea of tranquility," said Manus Clancy, Senior Managing Director at Trepp. "While market watchers were worried about lower US GDP, an overly strong dollar, and sagging corporate earnings, the CMBS market was as steady as could be. Spreads remained largely unchanged in March, new issuance was solid, CMBS volatility was light, and the delinquency rate was flat. That performance compared to the big whipsaws in US stock prices seemingly each day in March."

The Trepp CMBS Delinquency Rate was unchanged in March, interrupting the recent string of falling delinquencies. After falling for four consecutive months, the delinquency rate for US commercial real estate loans in CMBS remains 5.58%. The percentage of seriously delinquent loans, defined as those 60+ days delinquent, in foreclosure, REO, or non-performing balloons, fell one basis point to 5.41%.

Almost $1.1 billion in CMBS loans became newly delinquent in March, bringing total delinquencies to $29.4 billion, slightly below the total as of month-end February. Over $800 million loans were cured last month, while $570 million loans that were previously delinquent paid off either at par or with a loss.

The decline in the pace of loan resolutions does not come as a surprise. After a torrid pace in 2012 and 2013, liquidations have slowed for the time being. As the market gets further into the cycle of 2006 and 2007 10-year loans reaching their maturities, Trepp expects liquidation volume numbers to start to pick up again.

"The financial markets were turbulent in March, but the CMBS market remained a sea of tranquility," said Manus Clancy, Senior Managing Director at Trepp. "While market watchers were worried about lower US GDP, an overly strong dollar, and sagging corporate earnings, the CMBS market was as steady as could be. Spreads remained largely unchanged in March, new issuance was solid, CMBS volatility was light, and the delinquency rate was flat. That performance compared to the big whipsaws in US stock prices seemingly each day in March."

Monday, March 2, 2015

Why Chinese companies rush to buy Manhattan's commercial property

Chinese investors' rapidly growing appetite for high-profile U.S. commercial properties has been highlighted as China's Anbang Insurance Group Co., the buyer of luxury hotel Waldorf Astoria, has agreed to buy 21 floors of an office building on the famed Fifth Avenue in Manhattan, New York City, recently.

The coveted building is located at 717 Fifth Avenue on East 56th Street. Anbang will buy it from Blackstone Group, the leading U.S. private equity firm. The cost would be between 400 million to 500 million U.S. dollars. It is said that Anbang would only buy the office portion, which starts from floor 5 to 26. The first four floors for retail are not included.

This Chinese insurer has made headlines with the acquisition of Waldorf Astoria, the landmark hotel on Park Avenue last October. Under the agreement, Anbang purchased the iconic luxury hotel for 1.95 billion dollars from Hilton Worldwide Holdings.

Anbang Insurance Group Co. is one of China's comprehensive group companies in insurance business. According to corporate sources, Anbang has been developing stably and reached a total asset of 800 billion yuan (about 130 billion U.S. dollars).

Anbang is not alone. Other Chinese companies are also caught in the craze of buying into Manhattan commercial real estate, which is regarded as a "safe heaven."

In June 2013, the family of Zhang Xin, chief executive officer of Chinese real estate developer Soho, together with a Brazilian partner bought a 40 percent stake in General Motors Building for about 700 million dollars. Shanghai-based Fosun International Ltd. bought the One Chase Manhattan Plaza, the landmark building of lower Manhattan in December 2013 from J.P. Morgan Chase & Co. for a consideration of 725 million U.S. dollars.

Also, the Bank of China reached a deal in December to buy a Manhattan office tower for nearly 600 million dollars.

Chinese companies believe that they could achieve stable returns from the U.S. commercial real estate. "Given the strong performance in the past, the group intends to realize long-term stable investment return by investing in high quality real properties in North America. Going forward it will increase the share of overseas assets in asset allocation, taking Europe and North America as priority areas," Anbang said after its Waldorf acquisition.

The recovering of U.S. economy has boosted the rents and transactions of office buildings, especially in big cities like New York. And foreign buyers are going after top-of-the-line properties in Manhattan.

The New York City property investment sales market saw 442 deals close last year, shattering the previous record of 346 deals in 2007. The year of 2014 was also the second most active year in terms of dollar volume, with 39.8 billion dollars in business volume, second only to the 48.5 billion dollars struck in 2007, according to a report of Jones Lang LaSalle, a real estate consulting company.

Looking forward, "foreign capital is likely to continue to aggressively pursue opportunities, seeking long-term capital appreciation in what is viewed as the world's largest and most stable market. The dollar is also rising against major currencies. Dividends and future sale prices will be exchanged in appreciated dollars to foreign investors. With many local private market and private equity funds also actively looking for new properties, there will be no shortage of demand for Manhattan office buildings, " Commercial Real Estate service company Colliers International said in a recent report.

For many Chinese companies, overseas investment is also a kind of asset allocation diversification. Anbang said it has developed a well-structured global strategy to seize the opportunities brought by economic globalization and deliver services to customers around the world following their steps of "going global. "

The coveted building is located at 717 Fifth Avenue on East 56th Street. Anbang will buy it from Blackstone Group, the leading U.S. private equity firm. The cost would be between 400 million to 500 million U.S. dollars. It is said that Anbang would only buy the office portion, which starts from floor 5 to 26. The first four floors for retail are not included.

This Chinese insurer has made headlines with the acquisition of Waldorf Astoria, the landmark hotel on Park Avenue last October. Under the agreement, Anbang purchased the iconic luxury hotel for 1.95 billion dollars from Hilton Worldwide Holdings.

Anbang Insurance Group Co. is one of China's comprehensive group companies in insurance business. According to corporate sources, Anbang has been developing stably and reached a total asset of 800 billion yuan (about 130 billion U.S. dollars).

Anbang is not alone. Other Chinese companies are also caught in the craze of buying into Manhattan commercial real estate, which is regarded as a "safe heaven."

In June 2013, the family of Zhang Xin, chief executive officer of Chinese real estate developer Soho, together with a Brazilian partner bought a 40 percent stake in General Motors Building for about 700 million dollars. Shanghai-based Fosun International Ltd. bought the One Chase Manhattan Plaza, the landmark building of lower Manhattan in December 2013 from J.P. Morgan Chase & Co. for a consideration of 725 million U.S. dollars.

Also, the Bank of China reached a deal in December to buy a Manhattan office tower for nearly 600 million dollars.

Chinese companies believe that they could achieve stable returns from the U.S. commercial real estate. "Given the strong performance in the past, the group intends to realize long-term stable investment return by investing in high quality real properties in North America. Going forward it will increase the share of overseas assets in asset allocation, taking Europe and North America as priority areas," Anbang said after its Waldorf acquisition.

The recovering of U.S. economy has boosted the rents and transactions of office buildings, especially in big cities like New York. And foreign buyers are going after top-of-the-line properties in Manhattan.

The New York City property investment sales market saw 442 deals close last year, shattering the previous record of 346 deals in 2007. The year of 2014 was also the second most active year in terms of dollar volume, with 39.8 billion dollars in business volume, second only to the 48.5 billion dollars struck in 2007, according to a report of Jones Lang LaSalle, a real estate consulting company.

Looking forward, "foreign capital is likely to continue to aggressively pursue opportunities, seeking long-term capital appreciation in what is viewed as the world's largest and most stable market. The dollar is also rising against major currencies. Dividends and future sale prices will be exchanged in appreciated dollars to foreign investors. With many local private market and private equity funds also actively looking for new properties, there will be no shortage of demand for Manhattan office buildings, " Commercial Real Estate service company Colliers International said in a recent report.

For many Chinese companies, overseas investment is also a kind of asset allocation diversification. Anbang said it has developed a well-structured global strategy to seize the opportunities brought by economic globalization and deliver services to customers around the world following their steps of "going global. "

Monday, February 23, 2015

Credit Suisse California Hotel CMBS Marks First Deal in 6 Years

Credit Suisse Group AG sold its first commercial-mortgage bond since 2008 with a $187 million deal tied to two beach-front hotels in Santa Monica, California.

Switzerland’s second-biggest bank is reentering the market as a surge in sales attracts new entrants, sparking concern lenders are loosening standards amid the competition. Credit Suisse’s last deal was an $887 million transaction in March 2008, according to data compiled by Bloomberg, three months before the market for securities tied to properties from skyscrapers to shopping malls shut down for more than a year in the wake of the financial crisis.

Wall Street banks are poised to issue more than $100 billion of the debt in 2014 after sales doubled to $80 billion last year, Bloomberg data show. Loans contained in deals sold this year are “substantially weaker” than those backing transactions issued in 2013, Barclays Plc analysts said in a report this month. About $8.4 billion in CMBS has been offered since January.

Almost one-quarter of mortgages in 2013 offerings are based on incomes that are at least 10 percent higher than landlords reported during the previous 12 months, Barclays analysts led by Keerthi Raghavan said in the Feb. 7 report. So-called pro-forma underwriting allowed property owners to pile on more debt during the boom years leading up to the property market crash in 2008 on the assumption that future earnings would be higher.

New Department Zurich-based Credit Suisse, which tried to rebuild its origination team in 2011, fired 50 people in October of that year without completing a deal as Europe’s sovereign debt crisis roiled credit markets. The bank restarted the group again last year.

The lender, ranked by newsletter Commercial Mortgage Alert as the fifth most-active underwriter of CMBS globally when issuance peaked in 2007, is taking a cautious approach to new deals by avoiding the types of transactions that require lenders to hold as much as $1 billion of mortgages on their books for months, according to people with knowledge of its strategy.

This week’s transaction is backed by a mortgage linked to the Shutters on the Beach and the Casa Del Mar in Santa Monica, California, according to Morningstar Inc. Top-ranked securities maturing in seven years were sold to pay 85 basis points, or 0.85 percentage point, more than the one-month London interbank offered rate, according to a person familiar with the sale who asked not to be identified because terms aren’t public.

The Shutters on the Beach and the Casa Del Mar are the only two beachfront properties in Santa Monica, Morningstar said in a report earlier this month. In 2009, during the depths of the recession, revenue at the properties dropped about 19 percent, compared with a decline of 35 percent for comparable hotels, according to Morningstar.

Hotels are one of the most volatile commercial-property types as changes in the economic climate affect them almost immediately with rates resetting every night. In addition to the $183 million mortgage, the properties are carrying $186 million of mezzanine loans, according to Morningstar.

Switzerland’s second-biggest bank is reentering the market as a surge in sales attracts new entrants, sparking concern lenders are loosening standards amid the competition. Credit Suisse’s last deal was an $887 million transaction in March 2008, according to data compiled by Bloomberg, three months before the market for securities tied to properties from skyscrapers to shopping malls shut down for more than a year in the wake of the financial crisis.

Wall Street banks are poised to issue more than $100 billion of the debt in 2014 after sales doubled to $80 billion last year, Bloomberg data show. Loans contained in deals sold this year are “substantially weaker” than those backing transactions issued in 2013, Barclays Plc analysts said in a report this month. About $8.4 billion in CMBS has been offered since January.

Almost one-quarter of mortgages in 2013 offerings are based on incomes that are at least 10 percent higher than landlords reported during the previous 12 months, Barclays analysts led by Keerthi Raghavan said in the Feb. 7 report. So-called pro-forma underwriting allowed property owners to pile on more debt during the boom years leading up to the property market crash in 2008 on the assumption that future earnings would be higher.

New Department Zurich-based Credit Suisse, which tried to rebuild its origination team in 2011, fired 50 people in October of that year without completing a deal as Europe’s sovereign debt crisis roiled credit markets. The bank restarted the group again last year.

The lender, ranked by newsletter Commercial Mortgage Alert as the fifth most-active underwriter of CMBS globally when issuance peaked in 2007, is taking a cautious approach to new deals by avoiding the types of transactions that require lenders to hold as much as $1 billion of mortgages on their books for months, according to people with knowledge of its strategy.

This week’s transaction is backed by a mortgage linked to the Shutters on the Beach and the Casa Del Mar in Santa Monica, California, according to Morningstar Inc. Top-ranked securities maturing in seven years were sold to pay 85 basis points, or 0.85 percentage point, more than the one-month London interbank offered rate, according to a person familiar with the sale who asked not to be identified because terms aren’t public.

The Shutters on the Beach and the Casa Del Mar are the only two beachfront properties in Santa Monica, Morningstar said in a report earlier this month. In 2009, during the depths of the recession, revenue at the properties dropped about 19 percent, compared with a decline of 35 percent for comparable hotels, according to Morningstar.

Hotels are one of the most volatile commercial-property types as changes in the economic climate affect them almost immediately with rates resetting every night. In addition to the $183 million mortgage, the properties are carrying $186 million of mezzanine loans, according to Morningstar.

Labels:

Barclays,

California,

Casa Del Mar,

CMBS,

Credit Suisse,

Santa Monica,

Shutters on the Beach

Saturday, February 21, 2015

Fitch: U.S. CMBS New Issue Metrics Worsen; Legacy Metrics Improve

The road continues to diverge between new issue and legacy metrics for U.S. CMBS, according to Fitch Ratings in its latest quarterly index report.

New issue metrics continue to decline as the percentage of new issue full and partial interest-only (IO) loans in Fitch-rated transactions rose by five percentage points last quarter. The increase was driven by an approximately four-percentage-point increase in full IO loans. In addition, Fitch-stressed LTVs continued to edge up, while stressed DSCRs were lower.

Meanwhile, metrics of legacy U.S. CMBS improved. Delinquencies in Fitch-rated transactions fell in fourth quarter-2014 (4Q'14), though the rate of declines slowed. This was largely due to a backlog of REO assets, which comprised nearly two-thirds of the index balance. Furthermore, the percentage of loans in special servicing declined again in 4Q'14 to $25.1 billion.

'The wave of upcoming CMBS maturities will begin in 2015, particularly in the second half of the year,' said Managing Director Mary MacNeill. The majority of 2015 loan maturities for Fitch-rated, fixed-rate multiborrower CMBS ($21 billion) are set to come due in 2H'15. Roughly $12 billion comes due in 1H'15 ($3.5 billion in 1Q'15). The majority of the higher-leveraged, peak-vintage loans mature between 2016 and 2017, which totaled $129 billion at YE14, excluding $11 billion that already defaulted and remain outstanding.

New issue metrics continue to decline as the percentage of new issue full and partial interest-only (IO) loans in Fitch-rated transactions rose by five percentage points last quarter. The increase was driven by an approximately four-percentage-point increase in full IO loans. In addition, Fitch-stressed LTVs continued to edge up, while stressed DSCRs were lower.

Meanwhile, metrics of legacy U.S. CMBS improved. Delinquencies in Fitch-rated transactions fell in fourth quarter-2014 (4Q'14), though the rate of declines slowed. This was largely due to a backlog of REO assets, which comprised nearly two-thirds of the index balance. Furthermore, the percentage of loans in special servicing declined again in 4Q'14 to $25.1 billion.

'The wave of upcoming CMBS maturities will begin in 2015, particularly in the second half of the year,' said Managing Director Mary MacNeill. The majority of 2015 loan maturities for Fitch-rated, fixed-rate multiborrower CMBS ($21 billion) are set to come due in 2H'15. Roughly $12 billion comes due in 1H'15 ($3.5 billion in 1Q'15). The majority of the higher-leveraged, peak-vintage loans mature between 2016 and 2017, which totaled $129 billion at YE14, excluding $11 billion that already defaulted and remain outstanding.

Wednesday, January 28, 2015

Slippery Situation: Oil’s Potential Impact on Real Estate

While it’s certainly good news for the majority of consumers, the sliding cost of oil and gas could gum up the works for some real estate owners and investors.

With crude oil prices hovering around $50 a barrel since the beginning of the year, industry watchdogs are voicing concerns about the threats to particular real estate markets and CMBS transactions.

Oversupply and weak demand have pushed crude oil down more than 55 percent from its recent peak of $107 a barrel in June 2014. For the regions and commercial assets that are fueled by the petroleum industry—including parts of Texas, Colorado and North Dakota—sustained low oil prices could lead to vacancies and reduced property incomes, several real estate observers cautioned.

That, in turn, could bring on a new wave of delinquencies on highly leveraged properties, as well as increased volatility in high-yield bonds, some said.

“What people are most worried about is exposure to real estate markets with a lot of oil-services tenants,” Trepp Senior Managing Director Manus Clancy told Mortgage Observer in mid-January, noting that so far the impacts are largely theoretical.

“Upon re-leasing, the office tenants in those spaces would look to either give up space or spend less money,” he said. “Houston seems to be ground zero for that concern.”

Mr. Clancy said the submarkets at greatest risk are the oilfield “man camps” in West and South Texas and North Dakota’s Bakken shale region, where oil workers drill for fresh supply.

“These are places where there may be a couple of limited-service hotels and multifamily properties and everyone is there just to drill,” he said. “Those will be the first places to close up and die if oil remains in the $40 to $50 range.”

Jana Partners, an activist hedge fund that once held a major investment in the recently spun-off oilfield lodgings company Civeo Corp. sold its entire $51 million stake in the Houston-based firm on Dec. 30, 2014, regulatory filings show.

The New York-based fund dumped its 12 million shares after Civeo announced plans to severely cut its 2015 spending to between $75 million and $85 million, from $260 million and $280 million in 2014, as previously reported. Civeo plans to close sites and further reduce its North American workforce.

Civeo’s stock closed at $3.14 a share on Jan. 21, down from about $25 a share in October 2014. Representatives for Jana and Civeo declined to comment.

Several other Houston-based companies that specialize in oil and oil services, including Baker Hughes and Schlumberger, have announced budget cuts and layoffs. Overall, oil company analysts have said they expect 500 to 800 U.S. drilling rigs to come out of service in 2015, the Houston Chronicle reported in late December.

Likewise, CMBS deals backed by properties with heavy oil-related tenant bases could also take a hit if oil prices remain at a sustained low for several months or more, according to Trepp and other industry sources.

“For the Houston market, the concern is that if you just took out a $100 million loan on an office property where you have three big energy tenants, your grade-A tenants may start to look like grade-B tenants,” Mr. Clancy said. “If oil prices remain low, the securitizer may wonder, ‘Will they shrink their square footage? Will they go out of business?’ he added. “Nobody can say for sure what will happen to these guys, so that’s where all eyes will be.”