Perhaps more so than any other industry, oil and its pricing volatility impacts all elements of the U.S. economy, both positively and negatively. Looking at it from a macroeconomic level, higher oil prices are good for some industries, and yet bad for others—and the same goes for lower prices. So overall, how does oil and energy affect the commercial real estate economy? Well, almost in the exact same way, if you break it down.

According to recent statistics from the U.S. Energy Information Administration., U.S. oil production will grow to 9.31 million barrels daily by 2016, so the industry is still healthy production-wise. But for the past few years, prices have remained low and are expected to remain steady or even decline for the foreseeable future. Where this has the greatest impact for commercial real estate is in the retail sector. It’s a simple equation: Reduced gas prices cause a boost in discretionary income and the end result is additional spending for the country. Money that would be typically earmarked towards filling car and home gas tanks now remains in the wallets of U.S. consumers and retailers are the clear beneficiaries.

It’s not a coincidence that the retail sector has shown a marked improvement as oil prices have plummeted. The 2014 holiday retail sales were strong and 2015 is expected to be much the same. By extension, another byproduct winner in this ripple effect are operators of industrial properties, particularly as online retail demand triggers the movement of purchased items through their facilities.

But while retailers and shopping center and industrial building owners celebrate continued affordable gas prices, commercial real estate within markets like Houston, where oil production is the “bread and butter” business, the news is not so welcome. In fact, the entire state of Texas, our country’s number one oil drilling state, has really been squeezed by the price decline.

The Lone Star State is always subject to the underlying forces of the energy sector. When oil fundamentals are strong and prices are up, Texas is a national economic leader. But when the opposite occurs, stunted financial growth is the unfortunate result. This decline has seeped into most of the regional commercial real estate segments such as the Texas office and retail sectors. In addition, a slowdown in local construction has been steadily occurring. Fortunately, Texans have learned from previous oil crunches to diversify the businesses to avoid being completely beholden to the energy industry—so while there has been some job loss, it has been mitigated to some degree.

But Texas and other localized markets specializing in energy aside, the current state of the oil industry and its lower than normal prices and the uplift in consumer spending has generally been considered a good thing for commercial real estate. While the long-term future of oil prices remains a mystery, retailers will still be able to ride this wave for the time being.

Showing posts with label oil. Show all posts

Showing posts with label oil. Show all posts

Tuesday, July 14, 2015

Wednesday, January 28, 2015

Slippery Situation: Oil’s Potential Impact on Real Estate

While it’s certainly good news for the majority of consumers, the sliding cost of oil and gas could gum up the works for some real estate owners and investors.

With crude oil prices hovering around $50 a barrel since the beginning of the year, industry watchdogs are voicing concerns about the threats to particular real estate markets and CMBS transactions.

Oversupply and weak demand have pushed crude oil down more than 55 percent from its recent peak of $107 a barrel in June 2014. For the regions and commercial assets that are fueled by the petroleum industry—including parts of Texas, Colorado and North Dakota—sustained low oil prices could lead to vacancies and reduced property incomes, several real estate observers cautioned.

That, in turn, could bring on a new wave of delinquencies on highly leveraged properties, as well as increased volatility in high-yield bonds, some said.

“What people are most worried about is exposure to real estate markets with a lot of oil-services tenants,” Trepp Senior Managing Director Manus Clancy told Mortgage Observer in mid-January, noting that so far the impacts are largely theoretical.

“Upon re-leasing, the office tenants in those spaces would look to either give up space or spend less money,” he said. “Houston seems to be ground zero for that concern.”

Mr. Clancy said the submarkets at greatest risk are the oilfield “man camps” in West and South Texas and North Dakota’s Bakken shale region, where oil workers drill for fresh supply.

“These are places where there may be a couple of limited-service hotels and multifamily properties and everyone is there just to drill,” he said. “Those will be the first places to close up and die if oil remains in the $40 to $50 range.”

Jana Partners, an activist hedge fund that once held a major investment in the recently spun-off oilfield lodgings company Civeo Corp. sold its entire $51 million stake in the Houston-based firm on Dec. 30, 2014, regulatory filings show.

The New York-based fund dumped its 12 million shares after Civeo announced plans to severely cut its 2015 spending to between $75 million and $85 million, from $260 million and $280 million in 2014, as previously reported. Civeo plans to close sites and further reduce its North American workforce.

Civeo’s stock closed at $3.14 a share on Jan. 21, down from about $25 a share in October 2014. Representatives for Jana and Civeo declined to comment.

Several other Houston-based companies that specialize in oil and oil services, including Baker Hughes and Schlumberger, have announced budget cuts and layoffs. Overall, oil company analysts have said they expect 500 to 800 U.S. drilling rigs to come out of service in 2015, the Houston Chronicle reported in late December.

Likewise, CMBS deals backed by properties with heavy oil-related tenant bases could also take a hit if oil prices remain at a sustained low for several months or more, according to Trepp and other industry sources.

“For the Houston market, the concern is that if you just took out a $100 million loan on an office property where you have three big energy tenants, your grade-A tenants may start to look like grade-B tenants,” Mr. Clancy said. “If oil prices remain low, the securitizer may wonder, ‘Will they shrink their square footage? Will they go out of business?’ he added. “Nobody can say for sure what will happen to these guys, so that’s where all eyes will be.”

One prominent B-piece buyer who spoke at CRE Financial Council’s January 2015 conference in Miami Beach said that some recently issued securitizations for non-prime Texas developments are in jeopardy with oil and gas prices down. That buyer, who could not be named due to a strict conference policy on attribution, said those CMBS loans had been originated with high loan-to-value ratios and that the properties’ projected revenue streams relied on continued oil sector growth.

Now that that growth has been stymied, the panelist said he fears the loans may be headed to special servicing in the near future. That speaker and other industry representatives at CREFC declined to go on the record with their comments.

To be sure, others see the drop in oil prices as a minor concern in the context of a stable economy and rejuvenated real estate industry.

“The geographic diversity of other assets in multi-borrower deals will mitigate oil price exposure for CMBS,” Mary MacNeill, managing director of U.S. CMBS at Fitch Ratings, told Mortgage Observer.

There are no records of a single-asset securitized loan on a property in Texas, according to Fitch. However, the loan could still bring down the cash flow of securitizations that hold other mortgages.

“Vacancies in certain markets will rise over time if oil prices stay low for a more protracted period,” said Ms. MacNeill. “Particularly for office properties in Houston or other oil-dependent markets.”

The city of 2.1 million people, which is commonly referred to as the “energy capital of the world,” houses more than 5,000 energy-related firms, according to city government data.

Among several buildings in Houston that could be exposed are two office properties: Two Westlake Park at 580 Westlake Park Boulevard, owned by Houston-based Hicks Ventures, and Two Allen Center at 1200 Smith Street, owned by Brookfield Office Properties, loan documents provided by Trepp show.

Two Westlake Park is 80 percent leased to ConocoPhillips and BP, while Two Allen Center is 52 percent leased to U.S.-based natural gas and oil producer Devon Energy Corporation. Civeo is based in nearby Three Allen Center at 333 Clay Street, also owned by Brookfield.

The Devon Energy lease does not expire until 2020, which gives the space “minimal near-term exposure,” according to a Brookfield spokesperson.

“While Houston is considered a resource market, its economy is clearly more diversified now than it was during the ’80s and ’90s,” said Paul Frazier, head of the real estate giant’s Houston region. “Furthermore, the mid-stream and down-stream sectors of the energy space are also prominent in our economy, which gives us a hedge against lower commodity prices.”

Tom Fish, co-head of real estate investment banking in JLL’s capital markets group, also said that Houston’s economy and real estate market are adaptable enough to handle a shock to the oil industry.

“I don’t expect developers and projects to be going bankrupt or for there to be a string of foreclosures because of over-leveraged debt,” said Mr. Fish, who is based in Texas’ most populous city. “The capital markets for new development are efficient enough to withstand distress in the market,” he said. “I was here during the oil downturn of the ’80s and I don’t think we’re there again.”

Still, Mr. Fish said that there are concerns about the future of office and high-end multifamily properties in Houston with crude oil prices at such a low.

“Those have been the two most active sectors of construction in our city for the past few years,” he said. “If oil prices were to stay below $50 a barrel for several years, it would take its toll, but we are a long way from reaching a point where we see a lot of defaults.”

For the time being, low oil prices create a boon for retail companies, medical facilities, technology firms, and low- to moderate-income residences, Mr. Fish said.

“We’re a consumer-driven economy,” he told Mortgage Observer. “There’s no better way to turbocharge that than to put money back into consumers’ pockets.”

Labels:

Baker Hughes,

Bakken,

BP,

Brookfield,

Civeo,

CMBS,

Colorado,

ConocoPhillips,

Devon Energy,

hotels,

Houston,

Jana,

JLL,

multifamily,

North Dakota,

oil,

oil prices,

Schlumberger,

Texas,

Trepp

Tuesday, January 20, 2015

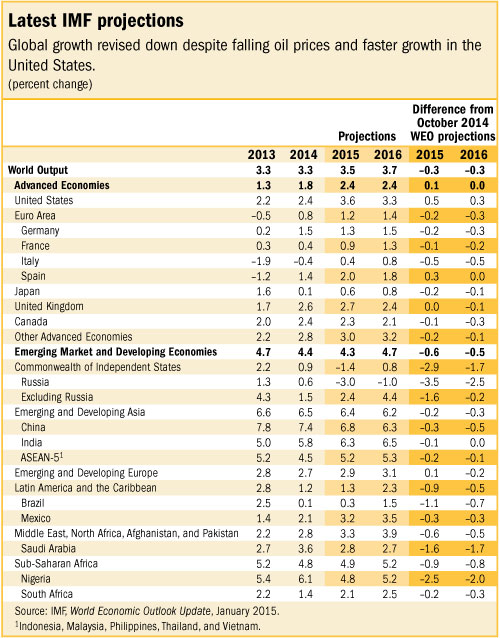

IMF: Global Growth Revised Down, Despite Cheaper Oil, Faster U.S. Growth

Even with the sharp oil price decline—a net positive for global growth—the world economic outlook is still subdued, weighed down by underlying weakness elsewhere, says the IMF’s latest WEO Update.

Global growth is forecast to rise moderately in 2015–16, from 3.3% in 2014 to 3.5% in 2015 and 3.7% in 2016 (see table), revised down by 0.3% for both years relative to the October 2014 World Economic Outlook (WEO).

Recent developments, affecting different countries in different ways, have shaped the global economy since the release of the October WEO, the report says. New factors supporting growth—lower oil prices, but also depreciation of euro and yen—are more than offset by persistent negative forces, including the lingering legacies of the crisis and lower potential growth in many countries.

“At the country level, the cross currents make for a complicated picture,” says Olivier Blanchard, IMF Economic Counsellor and Director of Research. “It means good news for oil importers, bad news for oil exporters. Good news for commodity importers, bad news for exporters. Continuing struggles for the countries which show scars of the crisis, and not so for others. Good news for countries more linked to the euro and the yen, bad news for those more linked to the dollar.”

Cross currents in global economy

In advanced economies, growth is projected to rise to 2.4% in both 2015 and 2016. Within this broadly unchanged outlook, however, is the increasing divergence between the United States, on the one hand, and the euro area and Japan, on the other.

For 2015, the U.S. economic growth has been revised up to 3.6%, largely due to more robust private domestic demand. Cheaper oil is boosting real incomes and consumer sentiment, and there is continued support from accommodative monetary policy, despite the projected gradual rise in interest rates. In contrast, weaker investment prospects weigh on the euro area growth outlook, which has been revised down to 1.2%, despite the support from lower oil prices, further monetary policy easing, a more neutral fiscal policy stance, and the recent euro depreciation. In Japan, where the economy fell into technical recession in the third quarter of 2014, growth has been revised down to 0.6%. Policy responses, together with the oil price boost and yen depreciation, are expected to strengthen growth in 2015–16.

In emerging market and developing economies, growth is projected to remain broadly stable at 4.3% in 2015 and to increase to 4.7% in 2016—a weaker pace than forecast in the October 2014 WEO. Three main factors explain this downward shift.

• First, the growth forecast for China, where investment growth has slowed and is expected to moderate further, has been marked down to below 7%. The authorities are now expected to put greater weight on reducing vulnerabilities from recent rapid credit and investment growth and hence the forecast assumes less of a policy response to the underlying moderation. This lower growth, however, is affecting the rest of Asia.

• Second, Russia’s economic outlook is much weaker, with growth forecast downgraded to negative 3.0% for 2015, as a result of the economic impact of sharply lower oil prices and increased geopolitical tensions.

• Third, in many emerging and developing economies, the projected rebound in growth for commodity exporters is weaker or delayed compared with the October 2014 WEO projections, as the impact of lower oil and other commodity prices on the terms of trade and real incomes is taking a heavier toll on medium-term growth. For many oil importers, the boost from lower oil prices is less than in advanced economies, as more of the related windfall gains accrue to governments (for example, in the form of lower energy subsidies).

Risks to recovery

The distribution of risks to global growth is more balanced than in October, notes the WEO Update. On the upside, lower oil prices could provide a greater boost than assumed. Other risks that could adversely affect the outlook involve the possible shifts in sentiment and volatility in global financial markets, especially in emerging market economies. The exposure to these risks, however, has shifted among emerging market economies with the sharp fall in oil prices. It has risen in oil exporters, where external and balance sheet vulnerabilities have increased, while it has declined in oil importers, for whom the windfall has provided increased buffers.

Policy priorities

The weaker global growth forecast for 2015–16 underscores the need to raise actual and potential growth in most economies, emphasizes the WEO Update. This means a decisive push for structural reforms in all countries, even as macroeconomic policy priorities differ.

In most advanced economies, the boost to demand from lower oil prices is welcome. It will also lower inflation, however, which may contribute to a further decline in inflation expectations, increasing the risk of deflation. Monetary policy must then stay accommodative to prevent real interest rates from rising, including through other means if policy rates cannot be reduced further. In some economies, there is a strong case for increasing infrastructure investment.

In many emerging market economies, macroeconomic policy space to support growth remains limited. But lower oil prices can alleviate inflation pressure and external vulnerabilities, giving room to central banks to delay raising policy interest rates.

Oil exporters, for which oil receipts typically contribute a sizable share of fiscal revenues, are experiencing larger shocks in proportion to their economies. Those that have accumulated substantial funds from past higher prices can let fiscal deficits increase and draw on these funds to allow for a more gradual adjustment of public spending to the lower prices. Others can resort to allowing substantial exchange rate depreciation to cushion the impact of the shock on their economies.

Lower oil prices also offer an opportunity to reform energy subsidies and taxes in both oil exporters and importers. In oil importers, the saving from the removal of general energy subsidies should be used toward more targeted transfers to protect the poor, lower budget deficits where relevant, and increase public infrastructure if conditions are right.

Labels:

China,

deflation,

emerging market,

Euro,

global growth,

IMF,

inflation,

Japan,

oil,

quantitative easing,

Russia,

US

Subscribe to:

Posts (Atom)